Monrovia — The Central Bank of Liberia (CBL) has acknowledged a one-percent drop in Liberia’s economic growth rate, aligning with recent projections from the International Monetary Fund (IMF). However, the Bank remains optimistic that the nation’s economy will surpass the IMF’s revised growth target for 2025, buoyed by strong performance in key productive sectors.

By Gerald C. Koinyeneh, [email protected]

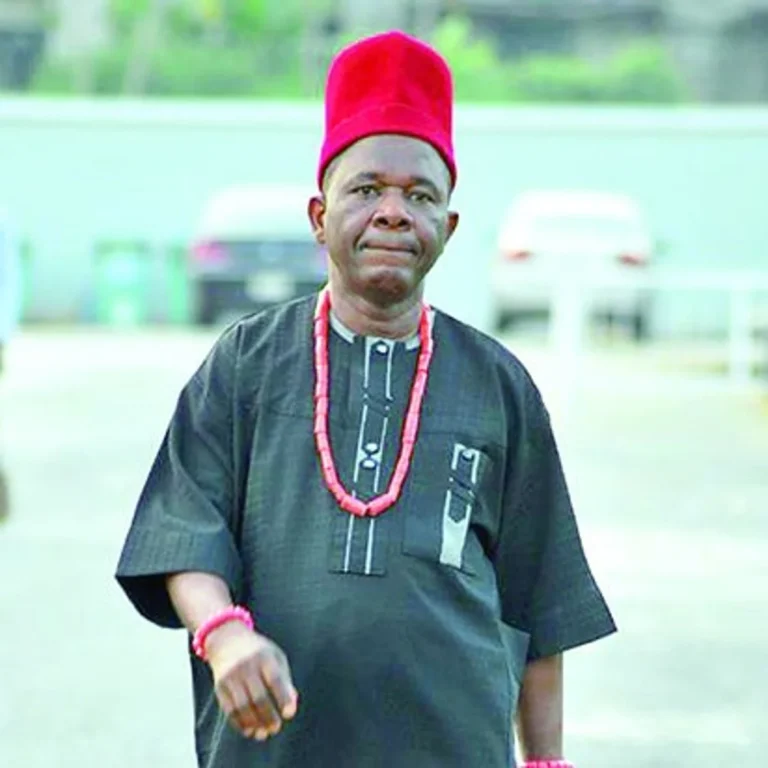

The IMF had recently downgraded Liberia’s 2025 growth forecast from 5.6 percent to 4.6 percent, citing persistent structural bottlenecks, governance challenges, and limited competitiveness. Despite the downgrade, CBL Executive Governor Henry F. Saamoi expressed confidence that current economic data point toward a stronger rebound than projected.

“Based on that analysis, we adjusted the growth projection for 2025 from 5.6% to 4.6%. We agreed with them [IMF], but based on the data, we are seeing huge movement in those sectors,” Governor Saamoi said.

“We are very much assured that we can exceed the growth projection for 2025 in the critical sectors of the economy. There is an increase in gold and rubber production. But when these estimates were made, there was a subdued projection in terms of more movement within the private sector. What we are seeing now is that the projection has doubled. So, when the data is reviewed, we believe that we will exceed the growth projection,” he added.

IMF Downgrade and CBL’s Response

The IMF’s recent review urged the Liberian government to sustain reform momentum under the Extended Credit Facility (ECF) program and tackle long-standing weaknesses that have constrained inclusive growth.

“Growth is projected at 4.6 percent in 2025 and 5.4 percent in 2026. Medium-term prospects remain favorable with GDP growth expected to stabilize at 5.5 percent, assuming full and timely implementation of the ECF-supported reform program,” the IMF stated.

The Fund also emphasized the need for continued fiscal discipline, improved financial sector stability, and structural reforms to curb corruption and enhance competitiveness.

CBL’s Optimistic Outlook

Despite acknowledging the IMF’s conservative outlook on Liberia’s economy, the Central Bank of Liberia (CBL) remains optimistic that the country will exceed its 2025 growth projection. The Bank attributes this confidence to visible improvements in key sectors such as mining, agriculture, and private enterprise development—all of which have outperformed earlier expectations.

Executive Governor Henry F. Saamoi said sustained increases in gold and rubber production, coupled with renewed private sector dynamism, are driving stronger economic activity across the country.

“When these new data are taken into account, we are confident that Liberia’s growth for 2025 will outpace current projections,” Saamoi told FrontPage Africa during the reading of the October 2025 Monetary Policy Communiqué adopted by the Bank’s Monetary Policy Committee (MPC) on Friday.

The CBL reaffirmed its commitment to maintaining macroeconomic stability and aligning monetary and fiscal policies with the goal of promoting sustainable and inclusive growth.

Policy Rate Cut Reflects Growing Confidence

At the core of the MPC’s decision was the announcement of a reduction in the Monetary Policy Rate (MPR) from 17.25 percent to 16.25 percent, citing improved economic fundamentals and a more stable macroeconomic outlook.

“After reviewing all reports, the Committee reduced the main interest rate, called the Monetary Policy Rate, by one percentage point to 16.25 percent,” Governor Saamoi explained. “This decision shows confidence that prices are stabilizing and the economy remains strong.”

Saamoi said the move was informed by better-than-expected global growth and easing inflationary pressures. Citing the IMF’s latest forecast, he noted that global growth in 2025 is projected at 3 percent, up from earlier estimates.

He, however, cautioned that trade tensions, geopolitical risks, and tariff disputes continue to pose challenges for emerging economies.

“Despite these risks, Liberia is benefitting from declining global food and fuel prices and higher gold prices, which have boosted export earnings,” he said.

According to the CBL, global inflation is expected to fall from 5.6 percent in 2024 to 4.2 percent in 2025, largely due to lower oil prices—a development Saamoi described as “good news” for Liberia’s import-dependent economy.

Domestic Growth Strengthens, Inflation Falls

Governor Saamoi disclosed that Liberia’s economy remains on track to expand by about 4.6 percent in 2025, supported by a stronger services sector and steady remittance inflows.

“Inflation fell sharply from 11.1 percent in the previous quarter to 6.1 percent, mainly because food inflation dropped from 15.8 percent to 5.6 percent and imported goods became slightly cheaper,” he told reporters.

He projected a slight uptick in inflation during the holiday season but said it should remain around 6 percent, helped by a stable exchange rate and resilient trade flows.

Banking Sector Resilient

Governor Saamoi described the banking sector as “sound and resilient,” noting that all commercial banks continue to meet capital adequacy requirements.

“Banks have sufficient capital to cover their operations, with liquidity ratios well above the minimum threshold,” he said.

While lending activity slowed slightly, non-performing loans declined and cash reserves improved, signaling healthier balance sheets. Foreign reserves also rose modestly during the third quarter, while both government and private sector borrowing declined, contributing to a reduction in the total money supply.

“The government continued meeting its debt obligations and issued US$22.6 million in new treasury bonds during the quarter,” Saamoi said, commending fiscal authorities for “prudent spending and improved coordination” with the central bank.

Liberia also recorded a small trade surplus—exporting more than it imported—for the first time this year. Foreign reserves climbed to US$544.8 million, remittance inflows rose by 8 percent, and the Liberian dollar appreciated by about 9 percent.

Stakeholders Call for Reforms and Inclusion

Friday’s announcement drew a cross-section of business and community representatives, including marketers, forex bureau operators, and university students, who used the occasion to call for deeper economic reforms.

Madam Elizabeth Sambola, President of the Liberia Marketing Association (LMA), appealed to the CBL to intervene in restrictions placed by mobile money operators—Lonestar MTN and Orange Liberia—that limit marketers from sending or receiving certain transaction amounts.

Despite the appreciation of the Liberian dollar, there are concerns that prices of essential commodities have not fallen proportionally, creating a disconnect between currency gains and consumer costs.

Responding to a FrontPage Africa inquiry on the issue, Governor Saamoi explained that price reductions do not occur immediately when the local currency appreciates because businesses must first sell off existing inventories purchased at higher exchange rates.

“We saw the sharp appreciation of the currency, but prices did not automatically reduce,” he said. “When you conduct this inventory and the currency appreciates, reducing prices immediately would mean incurring losses. It takes time for the adjustment to reflect in the market.”