– Advertisement –

By Mohammed Jallow

The real estate sector stands today at an extraordinary inflection point. What was once perceived as a conservative bastion of land transactions and housing construction has metamorphosed into a dynamic engine of national economies. The industry’s growth trajectory is not incidental but rooted in fundamental economic shifts, demographic evolution, financial innovation, and the strategic recognition of property as a core wealth generator. This essay explores the underlying drivers of the real estate boom, evaluates its macroeconomic significance, outlines the multifaceted challenges inhibiting its full potential, and articulates a visionary framework through which real estate can catalyse sustainable employment, particularly for young people. In doing so, it probes the indispensable role of government, the fabric of public-private collaboration, and how socio-economic equilibrium might be attained through enlightened policy.

Today’s real estate boom is propelled by a confluence of factors that transcend geography and income levels. Urbanisation remains a primary catalyst. According to United Nations projections, more than two-thirds of the global population will reside in cities by 2050. As urban footprints expand, demand for residential, commercial, and mixed-use developments escalates commensurately. This spatial transformation reflects not only population concentration but also structural economic shifts toward services, industrial modernisation, and technological clusters anchored in urban centers.

– Advertisement –

Financial liberalisation has further accelerated the sector’s expansion. The proliferation of mortgage finance, innovative funding mechanisms such as real estate investment trusts, and increased foreign direct investment have unlocked capitals previously sidelined in asset classes with lower liquidity and return potential. In emerging economies, remittances from diaspora communities have become a profound source of property demand and investment. In the Gambia, for example, remittances contribute significantly to foreign exchange reserves and household expenditure, with a notable portion channeled into homesownership and construction. The cumulative effect of these financial flows has elevated real estate from a transactional commodity to a strategic investment class, underpinning household wealth accumulation and institutional portfolios alike.

Demographic forces also sculpt demand patterns. The youth bulge in Africa and parts of Asia creates unprecedented demand for starter homes, rental accommodation, and urban labor force housing. Millennials and Generation Z demonstrate distinct preferences that differ from preceding cohorts; they seek affordability, connectivity, and lifestyle-oriented living spaces. This demographic impetus positions real estate not merely as a product of economic growth but as a responsive sector that mirrors societal aspirations and generational priorities.

The economic impact of the real estate industry is both profound and pervasive. First, the sector acts as a multiplier of economic activity. Construction alone stimulates value across cement, steel, electrical and plumbing supplies, and architectural services. This inter-sectoral linkage amplifies GDP growth, employment, and ancillary industries such as financial services, legal services, and urban planning. For national economies striving for diversification, real estate represents both a growth lever and a stabiliser that can cushion against volatility in commodity or export-driven sectors.

– Advertisement –

Second, the industry is a principal driver of job creation. From laborers on construction sites to architects, engineers, property managers, and real estate agents, the sector supports a broad employment ecosystem. Given that most developing economies contend with high youth unemployment, real estate’s labor absorption capacity is exceptionally advantageous. More importantly, when integrated with skills development frameworks, the sector can elevate human capital by providing apprenticeships, certification pathways, and vocational opportunities that translate into sustainable livelihoods.

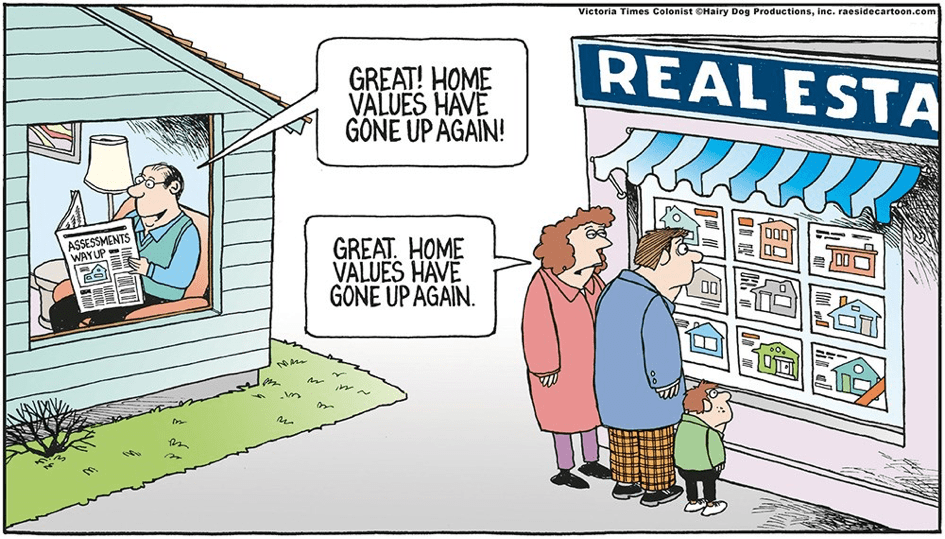

Third, real estate fuels capital formation and consumer confidence. Home ownership is a keystone of financial security for millions. Property provides collateral for entrepreneurial ventures, facilitating credit access and broadening the entrepreneurial base. Home equity and property price appreciation contribute to consumer confidence and domestic consumption. As property values rise, household balance sheets strengthen, catalysing a virtuous cycle of investment and spending.

Despite these compelling prospects, the real estate boom carries formidable challenges that require strategic intervention. The most salient is affordability. Rapid price escalation in urban cores often outpaces income growth, rendering housing inaccessible to low and middle-income families. When affordability gaps widen, they perpetuate slum proliferation, social inequality, and urban sprawl. The challenge is compounded by underdeveloped mortgage markets, high interest rates, and limited access to formal housing finance, especially for first-time buyers and informal sector workers.

Regulatory inefficiencies also undermine the sector’s potential. Complex land titling processes, ambiguous property rights, and bureaucratic red tape erode investor confidence and prolong project timelines. In many countries, fragmented planning systems result in uncoordinated urban development, environmental degradation, and infrastructure deficits that diminish the utility and sustainability of real estate investments.

Additionally, the industry’s traditional siloed approach to skills development fails to harness the potential of the youth cohort fully. Without systematic training pipelines and certification programmes, young people are often relegated to low-skilled, low-wage positions. This underutilisation of human capacity not only stifles individual potential but constrains the sector’s evolution toward innovation, technology adoption, and sustainable construction practices.

To transform the real estate boom into a strategic platform for sustainable growth and youth employment, governments must adopt a multi-layered and proactive approach. Public policy should prioritise inclusive frameworks that balance market dynamism with social equity. Below are key pillars of an effective national methodology.

1. Regulatory and institutional reform:

Governments must streamline land administration systems to ensure transparent, secure, and expedited property registration. Digital land registries, clear titling mechanisms, and enforceable property rights reduce transaction costs and promote formal investment. Moreover, harmonising urban planning with infrastructure development ensures that real estate growth aligns with transportation, utilities, and environmental resilience.

2. Affordable housing initiatives:

To bridge the affordability gap, governments should incentivise the construction of low and middle-income housing through tax breaks, public-private partnerships, and targeted subsidies. Affordable housing is not charity; it is a strategic investment in social stability, workforce retention, and economic productivity. Incentive schemes tied to performance indicators, such as unit completion rates and compliance with construction standards, can bolster impact.

3. Financial market deepening:

Strengthening mortgage finance institutions and broadening financial inclusion is crucial. Regulatory frameworks that encourage long-term, low-interest lending, risk-sharing instruments, and capital market instruments such as real estate investment trusts (REITs) will expand access to housing finance. Governments can catalyse this by creating enabling conditions for pension funds, insurance companies, and institutional investors to allocate more capital to real estate.

4. Skills development and workforce integration:

The real estate value chain should be deliberately leveraged as a youth employment engine. National skills development policies must integrate accredited vocational training programs, apprenticeships, and partnerships with technical institutes to build competencies in construction management, sustainable building technologies, property management, and real estate analytics. Such programmes should be aligned with industry needs and coupled with employment guarantees or placement services.

5. Sustainability and innovation:

Real estate’s future must be green, resilient, and technology-driven. Governments should enforce and incentivise green building standards, energy-efficient designs, and climate-adaptive infrastructure. By integrating sustainability into regulatory frameworks, countries can reduce long-term operating costs, mitigate environmental risk, and boost competitiveness. Additionally, embracing digital innovations such as proptech can enhance transparency, increase market efficiency, and open new entrepreneurship avenues.

6. Public-private collaboration:

No government can single-handedly engineer the real estate sector’s optimal growth. Multi-stakeholder mechanisms that bring together developers, financial institutions, community groups, and civil society can produce shared value frameworks that balance profitability with public good. Strategic alliances with international development partners can also introduce best practices, technical assistance, and blended finance models to scale high-impact projects.

The socio-economic implications of these reforms are profound. A well-functioning real estate sector enhances social stability by enabling homesownership and reducing precarious living conditions. It stimulates domestic capital formation, supports micro-enterprises, and expands the tax base without overburdening citizens. From a macroeconomic perspective, vibrant real estate markets increase foreign direct investment attractiveness, strengthen financial systems through diversified asset holdings, and support resilient urban economies that can withstand external shocks.

Investing in youth through the real estate sector has ripple effects that extend far beyond employment statistics. Gainful engagement in construction, property management, urban planning, and real estate technology empowers young people with transferable skills, strengthens intergenerational wealth creation, and anchors aspirations in constructive economic participation. When youth find purpose and opportunity in the built environment, societies benefit from reduced social tensions, increased productivity, and a more inclusive national narrative.

The key players in the real estate ecosystem encompass a diverse set of actors, each with distinct roles and responsibilities. Developers orchestrate project vision, execution, and financing. Financial institutions provide the capital that underpins transactions and construction activities. Regulatory bodies shape the legal and policy frameworks that govern land use, building codes, and investment conditions. Professional services—architects, engineers, surveyors, urban planners—infuse technical rigor and innovation. And crucially, communities and residents are both beneficiaries and stewards of the spaces created, whose needs must be central to planning and implementation.

The essence of strategic transformation lies in coherence—ensuring that policy, investment, and execution converge toward defined social and economic objectives. Governments, while facilitating private sector growth, must act as guardians of public interest, protecting rights, promoting inclusion, and safeguarding environmental integrity. Real estate should not be an enclave of speculative gain; it ought to be a pillar of shared prosperity.

In conclusion, the real estate boom is far more than an economic phenomenon; it is a reflection of human settlement patterns, societal ambitions, and fiscal evolution. Its impact on GDP, job creation, wealth formation, and urban resilience makes it indispensable to national development agendas. Yet, without deliberate policymaking, inclusivity measures, and forward-looking governance, the sector can exacerbate inequality and stall potential gains. Governments must rise to the moment by fostering an environment where real estate not only thrives but also empowers citizens, particularly youth, into productive, dignified, and sustainable livelihoods. Through strategic reforms, robust partnerships, and a relentless focus on socio-economic balance, the real estate industry can become a cornerstone of modern economies and a testament to visionary leadership.