The Lagos State Internal Revenue Service has reiterated the January 31, 2026 deadline for all employers of labour in Lagos State to fulfil their statutory obligation to file their annual tax returns for the 2025 financial year.

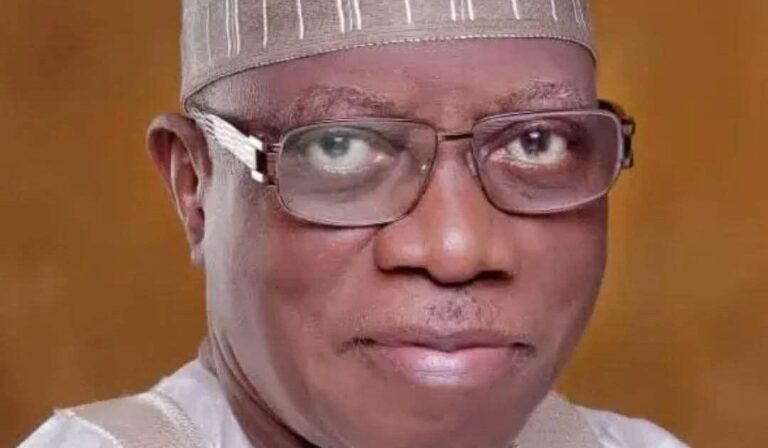

In a statement issued on Thursday, the Chairman of the LIRS, Dr Ayodele Subair, informed employers that the obligation to file annual returns is in accordance with the provisions of the Nigeria Tax Administration Act 2025.

Subair explained that employers are required to file detailed returns on emoluments and compensation paid to their employees, as well as payments made to their service providers, vendors and consultants, and to ensure that all applicable taxes due for the 2025 year are fully remitted.

He emphasised that the filing of annual returns is a mandatory legal obligation and warned that failure to comply would result in statutory sanctions, including administrative penalties, as prescribed under the new tax law.

He noted that, according to Section 14 of the Nigeria Tax Administration Act 2025, employers are required to file detailed annual returns of all emoluments paid to employees, including taxes deducted and remitted to the relevant tax authorities.

Such returns, he said, must be filed and submitted no later than January 31 each year.

“Employers must prioritise the timely filing of their annual income tax returns. Compliance should be part of our everyday business practice. Early and accurate filing not only ensures adherence to the law as required by the Nigerian Constitution, but also supports effective revenue tracking, which is important to Lagos State’s fiscal planning and sustainability.”

He further noted that in Lagos State, electronic filing via the LIRS eTax platform remains the only approved and acceptable mode of filing, as manual submissions have been completely phased out.

This measure, he said, is aimed at simplifying and standardising tax administration processes in the state.