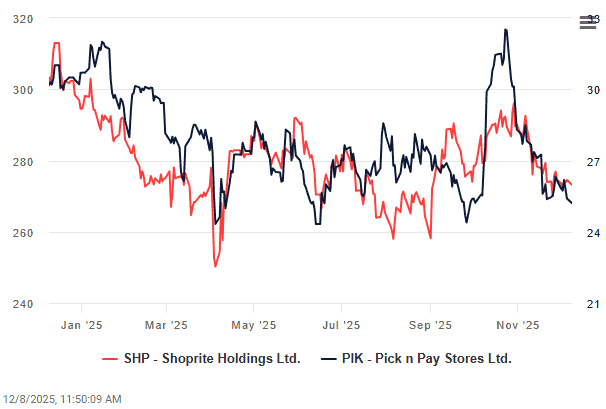

Over the past decade, the network of Pick n Pay Hypermarkets has barely grown.

The pace at which the Shoprite Group has expanded its larger-format Checkers Hyper footprint over the last decade has left its main rival in this segment, Pick n Pay, trailing far behind.

Between 2015 and 2025, the number of Checkers Hypers grew from 33 stores to 40, which is roughly double the number of Pick n Pay Hypermarkets in the country. In that same period, Pick n Pay added two stores, to get to a total of 22.

To get there, Shoprite Group has needed to add an average of one a year, although its additions have been lumpier, often with a few openings in the same year.

In the last financial year (between July 2024 to June 2025), it actually added three new Hyper stores but also shut one.

Shoprite has been incredibly successful at finding so-called ‘white space’ – locations where it can open larger stores in the metros and larger cities.

The most recent Checkers Hyper opening has been at the Mushroom Farm Centre on Allandale Road in Midrand.

There’s really not much around in that node, save for Attacq’s Mall of Africa Hyper, less than 4km down the road. Still, the two offers are almost completely different in terms of access and offering. That store opened at the end of October.

ALSO READ: Can Walmart win where Game failed?

Pick n Pay

Pick n Pay has been far less successful, with a mostly static store estate for Hypers.

In the 2024 financial year (to end-February 2024), Pick n Pay shut one Hypermarket and converted one of its supermarkets. That shuttered store, located in the Vaal, was closed in late 2023.

That closure was completely unrelated to the store estate reset programme announced by CEO Sean Summers in 2024.

Under that plan, as many as 100 stores would be converted or closed.

However, since that announcement, 27 of the 101 affected stores have turned profitable and will no longer be shut or converted into Pick n Pay franchise stores or Boxer outlets.

By the end of February, Pick n Pay will have converted/closed 65 supermarkets, with only another nine stores remaining.

In the last 12 months, Pick n Pay has smartly converted its supermarket at Liberty Midlands Mall in Pietermaritzburg to a Hyper, with the Longbeach store in Sun Valley near Fish Hoek, Cape Town also converted in November. It says it will carefully evaluate further conversions of its larger supermarkets.

ALSO READ: How Shoprite made R20 million profit per day

Alongside this, it has revamped its Steeledale (Joburg), Klerksdorp and Ottery (Cape Town) Hyper stores in the last six months. It is also undertaking a significant revamp of its Faerie Glen Hyper centre in Pretoria and will add additional lifestyle outlets.

Despite its rather static store rollout, there is a renewed focus and energy in the Hypermarket business.

Summers says Hypers “remain a key value and volume driver” for the group.

In this unit, it has outlined four “key” priorities:

- To reflow its stores (moving certain departments around);

- Resize and refurbish them to improve trading densities;

- Offer shoppers unique high-value specific deals and promos; and

- Improve the breadth of the range it offers.

Pick n Pay has also trailed Checkers in the appropriate sizing of these Hyper stores.

Checkers has been actively reducing the size of existing stores where possible and ensuring that new stores are far smaller than the traditional big-box outlets that both groups opened in the 1990s and 2000s.

Pick n Pay has tried – it almost halved the size of its Northgate Hyper in Joburg – but Checkers has just been swifter.

A walk around the Mushroom Park Checkers Hyper (also referred to as ‘The Precinct’) confirms this. Somehow, it manages to just fit so much more range into the same amount of space.

Summers has said that he would ideally like Hypermarkets to be 6 500m2 to 7 000m2. Currently, some are as large as 15 000m2 – which is astonishing given that the largest Checkers Hyper is the 11 000m2 store at Gateway in uMhlanga (relaunched in November 2024).

ALSO READ: Pick n Pay to report nearly half-a-billion rand loss but remains hopeful

The newest Checkers Hyper store, at Mushroom Farm, is 9 000m2, while an upcoming store at Irene Village Mall (which will only open in September 2026) will be 8 000m2.

There remains a place in the market for these bigger-box stores, which customers frequent either weekly or, more commonly, monthly.

These are not stores that one stops at daily.

Even Massmart has identified this gap in the market with its apparent strategy for the Walmart stores it is rolling out (currently in Joburg), mostly as conversions from previous Game outlets.

Both retailers enjoy the boost in margins from the Hyper stores. These larger stores have a far bigger selection of general merchandise such as appliances, homeware, clothing basics, garden, textiles and toys. Most of these categories trade at far better margins than staple food, groceries and fresh produce.

Generally, pure grocery retailers trade at sub-5% margins, but you’ll easily command higher single digits (sometimes low double digits) for products in some of these other categories.

This article was republished from Moneyweb. Read the original here.